Choose Marchan Payment

Policy coverages regardless of type

Results Include: Requested coverage limits cross-referenced by DOL, Complimentary Umbrella Verification on all personal auto and homeowners policies

- Powerful insight into your client's claim using the information you already have.

- Must include name of carrier and claim or policy number in submission.

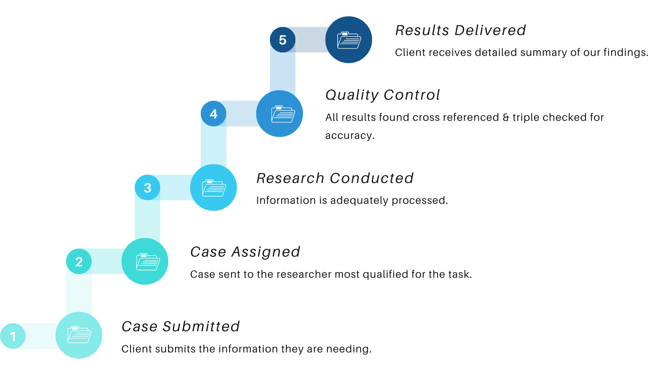

- All customer results are inspected and reviewed prior to forwarding.

- Commercial policy requests require 5 to 7 business days processing time.

- All other policy requests require 3 to 5 business days processing time.

- NO charge if unsuccessful

Create a custom treatment plan for your client based on available coverage. This search covers all personal auto policies. Highest accuracy in the industry you can be confident in the accuracy of your provided limits.

Find the applicable coverage for your clients' case offering hassle free limits on all homeowners, landlords, or renters policies. Umbrella pricing matches.

Can be ordered for most commercial policies and coverages including; commercial auto, general liability, UM/UIM, and commercial umbrella policies. Umbrella verification not included.

Let us point you in the right direction

Results Include: Insurance Carrier, Contact Info, Effective Date, and Policyholder

- Newest service package to be offered by Pacific Liability Research.

- Requiring only a $75 deposit, the Cursory search offers an easy and affordable alternative to our Insurance Discovery search when needing to identify any additional coverage or supporting policies.

- For successful processing, deposit is applied as a credit to final invoice.

- NO charges assessed past initial non-refundable deposit if results unsuccessful.

- Up to 14 days processing time

Utilize this search to perform a due diligence check for policy coverage prior to dropping cases without known coverage. First liability comes from the policy insuring the vehicle. Second liability comes from any policy covering the driver on the date of loss.

This includes renters and landlord policies as well. Research into any applicable umbrella policies, either private or corporate, cost the same if requesting a homeowners policy.

Leave no stone unturned in your required due diligence. Have us review your commercial claims for justified due diligence. Do not be fooled into potentially passing up millions in commercial coverage.

Obtain an additional policy offering coverage

Results Include: Insurance Carrier, Policy Number, Policy effective date verified by DOL, Base Liability

- $150 non-refundable deposit required

- For successful processing, deposit is applied as a credit to final invoice.

- Included with all inconclusive results you will be provided with our summary of findings.

- Policy found must offer coverage and be active on the date of loss.

- NO charges assessed past initial non-refundable deposit if unsuccessful.

- Up to 14 days processing time

Whether a hit and run or the at-fault party is just not cooperating. Your client is injured and you need to find coverage for this claim. There is no indication of who the carrier could be and all you have is the driver's vehicle info. Request this search to begin an investigation into the unknown carrier providing coverage.

Request a comprehensive search for any potential homeowners or renters policies offering coverage in your case. Typically requested with dog bite cases, ladder falls, and accidental drownings. Search carries a high probability of success. More often than not the requested policy is found.

From commercial trucking to corporate slip and falls and excess policies. Allow our experts to undergo a liability analysis on your case. Let our experienced staff troubleshoot and identify any potential liability leading to additional policies. Even if unsuccessful our summary of findings can be used to show due diligence prior to UM/UIM dispersal.

Specialty Carriers $30

State Farm, Mercury, Farmers Group, and Farm Bureau, AAA's (Texas and Southern California carry an additional $100 fee). Specialty carriers are a select group of prominent insurance carriers taking up a large portion of the insurance marketplace . There are higher costs associated with processing these requests requiring extensive time, attention, and expertise. A $30 "Specialty Carrier Fee", will be applied to final invoice upon successful completion of request.

Litigation $30

Research requests on cases in litigation are accepted and can be successfully processed. But due to the sensitive nature and mandatory protocol required for cases in litigation, a $30 "Litigation Fee", will be assessed and applied to final invoice.

Cancellation Fee $50

Applicable only when client is attempting to cancel a request that has already been completed by our team. This fee covers the research fees incurred in the successful processing of the case and pays the researcher who processed it.

Texas AAA, So. Cal AAA policies, additional $100

The vast majority of competitors do not accept policy requests for these carriers due to their difficulty and higher cost to research. Our research staff does accept these requests but upon successful completion, a $100 surcharge will be applied to the final invoice.

USAA- not accepted

Wawanesa- not accepted

American National- not accepted

We are unable to process requests for USAA, Wawanesa, and American National policies at this time.

Date of Loss > 1 year

The more time passes in relation to your client's case, the more increasingly difficult and expensive it becomes to research policies accurately and successfully. In recognition, requests with a date of loss of 1 year or more are subject to the following fees:

"Confirmed No Coverage"

"Confirmed No Coverage," is the term used when a limit request is made on a policy that for whatever reason does not offer coverage. Any information gathered during our research as to why will be provided in the notes portion of your returned results. Possibilities can range from excluded driver to a policy lapse. Whatever the reason, our research will attempt to locate the cause of "No Coverage" and will verify that no other policies with that carrier offer coverage. The costs of returning results of "Confirmed No Coverage," are no different than results of $1,000,000. It can equally be valuable identifying a case with no coverage than finding one with high coverage.

Umbrella Verification

All policy limit assessment requests for Personal Auto and Homeowners policies, will receive a complimentary umbrella verification. Performed at no cost for due diligence. If a policy is located, you will be notified. Policy will be made available for purchase for an additional $85. Option to purchase additional policies/excess coverage is completely to the client's discretion.

NO CHARGE FOR NO RESULTS

There is absolutely no charge to you if we are unsuccessful in processing your policy request. All case results must receive confirmation and approval from our Quality Control prior to sending.

100% REFUND GUARANTEED

We will gladly issue a full refund if incorrect or inaccurate results are provided. For verification, please provide a copy of the report indicating different coverages than that was provided in your results. We stand by our quality of work 100% aiming for unparalleled accuracy with each request we process. Deposits not included.

.png)

.png)

.png)

.png)